Manage Your Fixed and Variable Expenses To Achieve Your Financial Goals

Putting together a budget requires looking at a range of expenses. You expect some of those expenses month after month, but not others.

Expenses generally fall into one of two categories — fixed and variable. Understanding how they differ can help you handle current bills as well as future ones.

What Is a Fixed Expense?

Fixed expenses reoccur every month and are the same, or close to the same each month. You may also have "periodic" expenses that take place quarterly or annually like vehicle registrations, holiday or birthday spending, or tuition/fees if you have children in college.

The stability or repetitive nature of fixed expenses provides a good foundation for your budget. Knowing when you pay these expenses can help you manage your money.

Examples of Fixed Expenses

- Mortgage or rent

- Car loan or other loan payments

- Real estate taxes

- Insurance premiums

- Utilities (Cell phone, cable, or Internet service)

- Childcare expenses

- Monthly subscriptions or memberships

You can also count savings as a fixed expense when you're budgeting. Set aside the same amount of money for savings and retirement on a monthly basis to help put yourself in a financially secure position. And make saving a priority – always remember to pay yourself first.

What Is a Variable Expense?

Variable expenses may reoccur from month to month or haphazardly throughout the year, typically with fluctuating amounts. Some variable expenses can be planned for, and some cannot, making budgeting a challenge.

With variable expenses, it’s important to remember:

- Your choices sometimes influence these expenses

- Expenses vary from one person to another

- It can be hard to budget for variable expenses, but not impossible

- You may come up short some months if you're not tracking these variable expenses accurately

These kinds of expenses pop up a few times a year or show as regular monthly payments with varying amounts each month. Though it's difficult to track and budget, you still have control over your spending. For instance, you can use budgeting and spending apps to track your grocery bills, prescriptions, and even your monthly streaming subscriptions. Small changes to your spending can make saving easier and add up quickly. When it comes to saving money, you should consider making some daily changes to lessen your variable expenses such as minimizing your restaurant spending, canceling any unnecessary subscriptions, and restricting your online shopping.

Examples of Variable Expenses

- Medical bills

- Home or car repairs

- Entertainment

- Health care expenses

- Gas

- Groceries

- Utilities (Water, gas, or electricity)

Automate Your Expenses

Creating and using a budget is just one part of keeping track of your fixed and variable expenses. You have to learn how to effectively protect and manage your money. That’s where online banking and online bill payment come into play.

Online banking allows you to track and manage your expenses using your computer, tablet, or smartphone. In lieu of going into a branch, you can access your accounts through a website or mobile app. The service offers plenty of advantages – convenience, accessibility, automatic, and safety.

Unlike tracking your expenses through paper statements, online banking allows you to check your deposits, debits, and transfers in real-time. No need to worry about making any clerical errors by doing math by hand – online banking helps you avoid any overdrafts and fees. To best track your expenses, you can:

- Categorize your transactions and run reports

- Set up automatic payments

- View your account balances in real-time

- Easily transfer money between accounts

Adirondack Bank’s online banking gives you 24-hour access to account information at your convenience. It’s easy to use and secure. All you need is a connected device, and you can see your statements, view transaction history, make mobile deposits, set up banking alerts, and more.

Online banking even features a bill payment option to allow you set up and send automatic payments for your bills like your mortgage, cable, electric, credit cards, and more. Using this bill pay feature saves you time while avoiding late fees. To access your online bill pay, you just need to enroll in online banking. You can manage both your fixed and variable expenses in one place:

- View, pay, and track your bills from the payment center

- Receive electronic bills

- Schedule payments by due dates

- Transfer money from accounts at other financial institutions

- Set up reminder emails about upcoming payments

Make sure you know your true balance at all times and watch your accounts to make sure your payments are posted — don't have an "out of sight, out of mind" approach to bill paying. If you’re new to online bill pay, Adirondack Bank's Notifi tool can help. With more than 50 alerts, you have the option to receive email, text, or push notifications.

To help track your payments, set up real-time electronic alerts through online banking for your accounts. Choose which alerts work best for you including:

- Password changes

- Low balance information

- Transfers

- Transactions

- ATM activity

Make a Budget That Works

If you’re trying to reduce or cut back on your spending, fixed expenses can be easier to trim than variable expenses. If you are trying to pay less on a fixed expense, do some research and sharpen your bargain-hunting skills.

Variable expenses require you to make decisions about where you spend your money. You can save on variable expenses by making lifestyle adjustments:

- Refinance

- Shop for better deals

- Eat out less

- Forego shopping sprees

- Use coupons

- Switch from name brand products to generic versions

- Plan meals ahead of time so you don’t over spend at the grocery store

When you understand your bills and spending, you can create a budget that helps you save money on your fixed and variable expenses so you can use that extra money to build your savings or pay down debt faster. To get the most out of your spending plan, be sure to:

- Budget for the essentials first. This includes your home, insurance, and childcare expenses.

- Track variable spending. Keep expense categories to see how your budget trends over time. This makes it easier to decide how much money to assign to each category.

- Know your baseline. This is the bare minimum you would spend each month to get by.

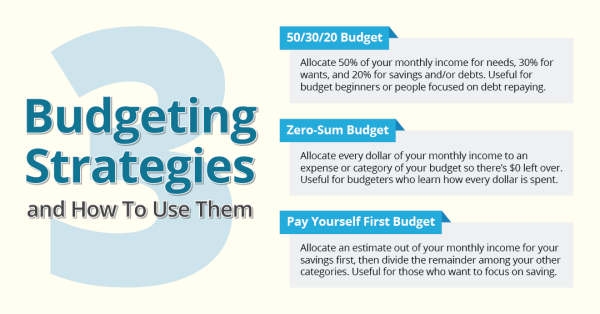

- Create a specific budgeting system such as a zero-based, 50/30/20, or pay-yourself-first budget.

- Plan for the worst. Surprise costs such as car or home repairs create challenges in your budget. Your emergency fund provides a safety cushion in your budget.

Ways We Can Help

Make sure you check out some of our banking tools to help maximize your spending plan.

- Our online calculators allow you to determine how much you can save or afford in personal finance, investment, and home finance.

- Our Financial Education Center gives you the critical knowledge and skills you need to make the best financial decisions.

- Our Video Resources teach you about Adirondack Bank's products and services, with informational videos to help your financial life.

Our dedicated staff is ready to help you choose the products and services that are right for you! Visit your nearest branch for details.

The information in this article was obtained from various sources not associated with Adirondack Bank. While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. Adirondack Bank is not responsible for, and does not endorse or approve, either implicitly or explicitly, the information provided or the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. Adirondack Bank makes no guarantees of results from use of this information.