Unlocking the Secrets of Homebuying: The Hidden Costs You Need to Know About

If you’re purchasing a house for the first time, the down payment and monthly mortgage payments are just the beginning.

You'll want to be aware of hidden costs throughout the entire homebuying and homeowning process. Learn how to add them into your budget and avoid surprises you can’t afford.

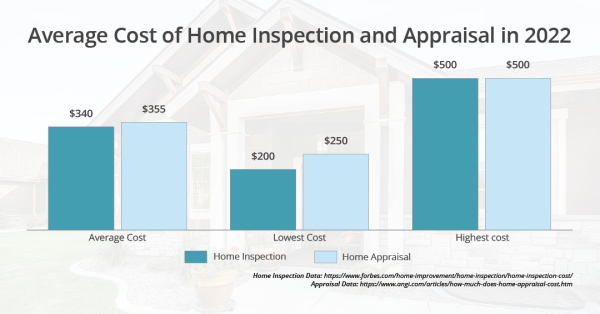

Inspection and Appraisal

Before you purchase your home, you should know exactly what you’re getting and what shape it’s in.

A home inspection is a visual safety and quality assessment to examine the condition of the home including the structural aspects of the home, heating and cooling systems, electrical work, and more to make sure they are functioning properly. An inspection will help you:

- Uncover any hidden issues.

- Give you the basis for negotiating repairs or a lower purchase price with the current owners.

A single-home inspection on average takes about two to four hours to complete depending on the size and condition of the home. This process will not only help catch any potential issues, but you’ll also feel better knowing there may not be major repairs now or down the road. The inspection gives you the options for purchase price and cost negotiations, and depending on the outcome, you can consider adding a contingency in the contract.

Keep in mind that the home inspection cost is paid at the time of service. It is one of the few fees that is not included in with the final closing costs.

After the inspection, both you and the seller will receive a copy of the report with summaries, photographs, and notes. It will also estimate the remaining life on major systems and equipment, roof, structure, paint, and finishes, and will recommend any repairs or replacements. Once you review the results, you can:

- Go ahead with the purchase as is. Make sure you know how much it will cost to make any repairs.

- Ask the seller to make any repairs. This can be a condition of the closing.

- Use the inspection report to negotiate a better price. The report may prove there is a significant number of repairs, meaning the seller may reduce the price to cover the fixes.

- Walk away. Your contract may have a contingency that allows you to back out without penalty or loss of money if the repairs are too expensive.

The inspection is just one aspect during the home-buying process. A home appraisal is also required before closing on a home. This is an independent estimate of the fair market value of a home. It is based on research of recently sold, comparable homes in your area, an inspection of the property, and the appraiser’s opinion. This review is conducted by a licensed or certified appraiser.

A home appraisal may take on average a few weeks depending on the size of the home and the current housing market. Under certain circumstances such as a high-end or specialty property, an appraisal may take longer.

Your mortgage lender will order an appraisal to confirm the value of the home. They must ensure they are offering the correct loan amount to the borrower. The loan amount is based on the sales price or appraisal value, whichever is lower. Once the appraisal is completed, you’ll receive a copy of the report. The report includes:

- Appraised value. This is a specific number the appraiser decides on after analyzing the home’s features and recent sales in the market.

- Property overview. The appraiser reviews the property’s age, location, square footage, occupancy, floor plan, number of bedrooms and bathrooms, design and quality of construction, heating and cooling systems, and landscaping.

- Any issues such as structural problems or design defects are listed in the report.

- Summary of local market trends. This is an overview of comparable properties, public records, and local market analysis.

- Other considerations. Other conditions may affect the home’s estimated value including easements or encroachments.

If the appraised amount is less than the asking price:

- The seller may reduce the price to match the appraisal.

- The buyer may pay the difference in cash at closing.

- The buyer walks away.

You’ll probably end up paying a fee to cover this service at the time of closing.

Closing Costs

Closing costs are a large grab bag of expenses you’ll have to pay as you wrap up your home purchase. Your closing costs will vary from state to state.

These frequently include:

- Mortgage interest payments.

- Title insurance.

- Fees for legal costs, originating the loan and recording the deed.

Your closing costs may include making an initial deposit into an escrow account. A portion of your total monthly mortgage payment will help pay for certain bills. Many lenders use escrow accounts to cover your:

- Property taxes. These are state, county, or city-level assessed. Rates vary from area to area so you should research these when house hunting and budgeting.

- Homeowners insurance premiums.

- Private mortgage insurance. If your down payment is less than 20 percent, you must pay a monthly or single premium.

- Other costs.

When the property tax and insurance bills are due, the mortgage company or bank will pay them from your escrow account on your behalf.

Taxes and Insurance

Property taxes and homeowners insurance premiums may be part of your closing costs, but they certainly don’t end there.

Your mortgage lender will require you to carry insurance on your home. Home insurance typically covers:

- Your home including the foundation, walls, and roof.

- Other structures on the property including a garage or deck.

- Personal property.

- Liability for injuries and damage to someone else's property.

- Fire.

- Natural disasters including lightning strikes, windstorms, and hail. You must buy a separate insurance policy for damage caused by earthquakes and floods.

It’s a good idea to keep this policy even after you’ve paid off the house.

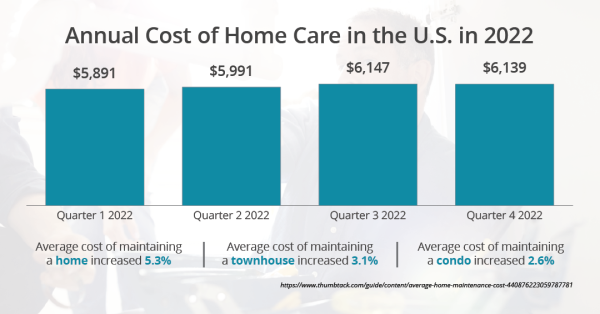

Utilities, Maintenance, and Repairs

As a first-time homebuyer, it’s your first time paying for all the utilities you use:

- Electricity

- Gas

- Water

- Sewer

- Internet

- Cable TV

- Trash/recycling collection

They may not be the most exciting expenses, but they are important when owning your own home. These are monthly statements of the basic services to keep your home running and comfortable. Your monthly bills will include the amount owed, the due date, ways to pay, and information about the service usage. Remember to pay your bills on time so you don’t risk late fees, damaged credit, and possible disruption in services.

You may also have homeowner's association (HOA) or condo fees that you pay on a monthly, quarterly, semi-annual, or annual basis. The cost normally covers garbage, shared utilities, security, and landscaping.

Since your home is an investment, it will need regular upkeep to help you stay safe. Maintenance is part of that upkeep, including internal and external work. On a regular basis, you should inspect your appliances, utilities, any outdoor landscaping, and more. If any repairs pop up, you are responsible for covering all your maintenance costs, including everything from lawn care to appliance upkeep. Repair and remodeling costs will also come out of your pocket.

Before you buy, consider what you might need to spend in the future to:

- Replace the roof.

- Buy new appliances.

- Inspect for mold and pests.

- Apply new paint.

- Service the heating, ventilation, and air conditioning system (HVAC).

Keep yourself on track with a home improvement and maintenance checklist to help you save time and money. This will make the responsibilities easier to manage.

Emergency Funds

You should set aside some money to help with potential repairs and maintenance on your home. If something goes wrong, you have the funds to cover it. Estimate between three to six months of living expenses.

Buying your first home is a huge step, so make the experience much less stressful. Plan ahead and budget for the major costs you’re sure to encounter along the way.

Refinancing Your Home

If you’re looking for a better interest rate for your mortgage, you may replace it with a new mortgage with better terms and a lower payment. Much like the process first-time homebuyers’ experience, refinancing your home requires closing costs. Some of the costs may include:

- Application fees

- Loan fees

- Home inspection fee

- Appraisal fee

- Title fee

- Mortgage recording fee

Check with a mortgage loan originator for full details about fees and closing costs if you decide to refinance.

Make Your Home Dreams Come True

Ready to purchase a home? We'll provide expert advice from the beginning of your home financing journey to the end.

Whether it's your first home or a refinance, we have the product that will suit your needs. Our mortgage products include:

- Fixed conventional mortgages.

- Construction mortgages.

- 5/1 and 10/1 adjustable rate mortgages (ARM).

- Investment property.

- Camp Financing Program.

- Federal Housing Administration (FHA) mortgages.

- Veterans Administration (VA) mortgages.

- U.S. Department of Agriculture (USDA) mortgages.

Let our team of professionals and dedicated staff help you choose the product that's right for you! When you’re ready, you can even start your mortgage application process online.

The information in this article was obtained from various sources not associated with Adirondack Bank. While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. Adirondack Bank is not responsible for, and does not endorse or approve, either implicitly or explicitly, the information provided or the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. Adirondack Bank makes no guarantees of results from use of this information.